The Geopolitical Case for Green Energy

Following the most recent ICPP report, there has been no shortage of calls to go green for the survival of our planet as we know it.

While that is enough for many politicians, others need more tangible, short-term reasons. Today we'll argue that going green is also just good geopolitics.

Specifically focusing on the EU, but much of it is relevant for any other region.

The current vulnerable system

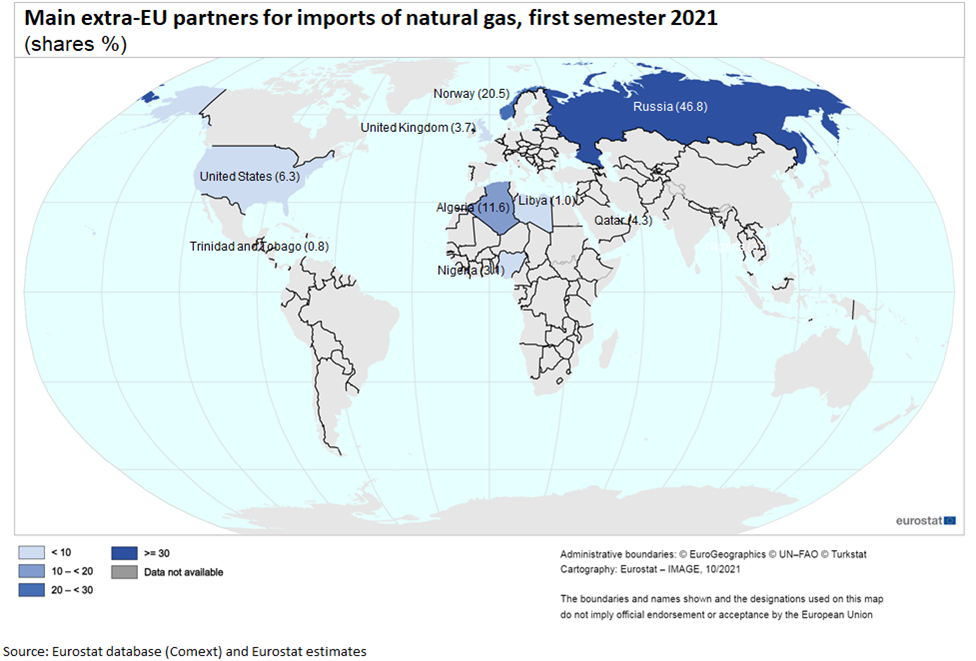

Currently the European Union gets around 60% of its energy from imports, primarily from Russia, the Middle East, and Norway.[1] This has two consequences.

First, Europe depends on this small group of producers for its energy needs, and second, these countries receive billions of Euros and Dollars for it. With the exception of Norway, these exporters are generally autocratic regimes, with bad human-rights records and geopolitical ambitions often contrary to the EU's. They are not real allies, but rather partners of necessity. While they disagree on almost everything else, Europe needs their energy, and they need Europe's (foreign) cash.

This dependency creates restrictions on how hard the EU can push for things like human-rights, social/environmental commitments, and foreign policy objectives. After all, producers can threaten to cut off, or increase the price of their energy. This already happens collectively, propping up prices with the oil cartel OPEC(+).

Russia is by far the largest fossil fuel exporter to the EU.[2]

Unsurprisingly, at no point during the Russian annexation of Crimea, the downing of MH17, or the battles in eastern-Ukraine, were there any sanctions placed on Russian oil or natural gas. Those imports were too important to risk, and are crucial for both sides.

Because it's not just Europe that depends on the flow, it's a major cash-cow for these regimes on the sell-side. Having a large informal economy, they largely depend on oil & gas revenues as their primary state-income.[3] Without fossil fuel revenues, there is no doubt Russia's military would be far smaller, and less capable of adventures in Ukraine, Georgia, or Syria.

"They have a lot of gas, and gas is becoming more and more expensive, which is good news for them and bad news for us," said Joseph Borell[4], High Representative of the EU on Foreign Affairs & Security policy, about Russia.

As Europe and the world move even more towards gas, which is less polluting than coal or oil, its dependency on Russia will grow even larger, as will its payments.

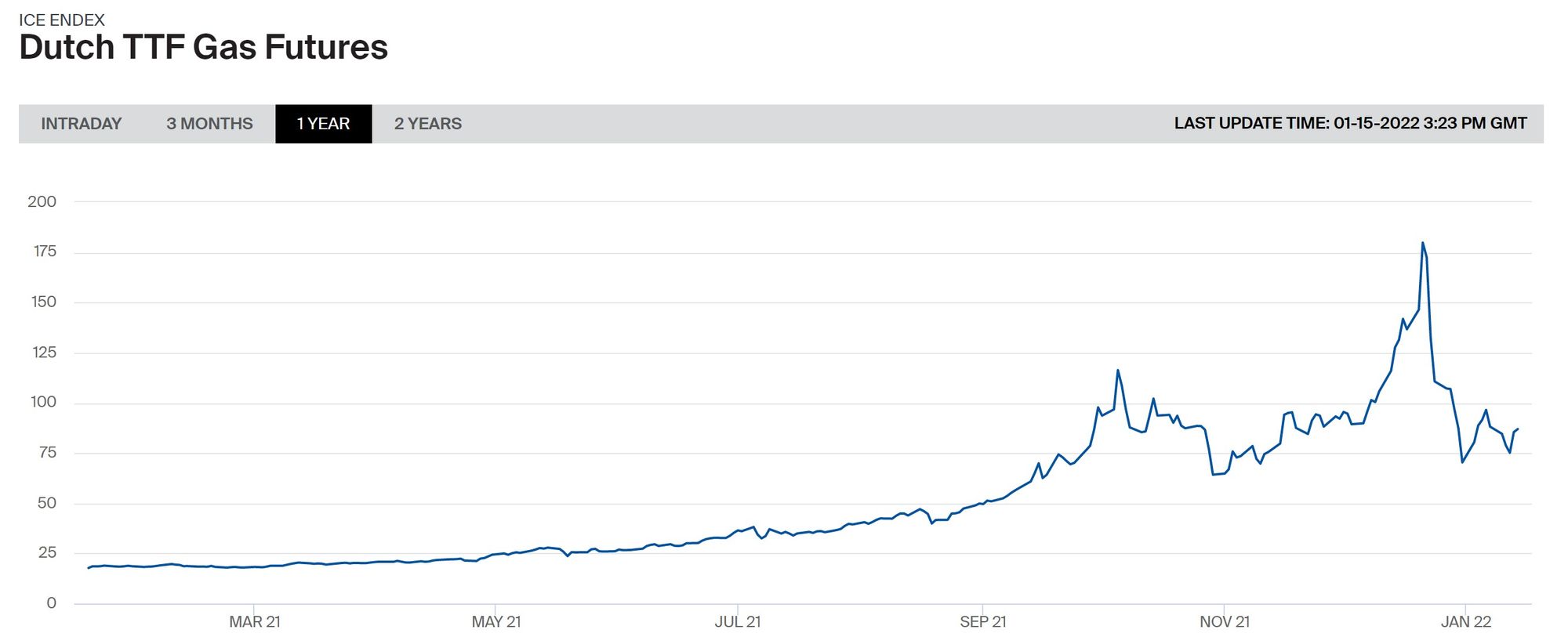

Recently, gas prices increased exponentially as Europe's demand for the gas outpaced supply. Dutch TTF Natural Gas, a benchmark for gas prices, hit an all time high of €180 per MWh, and is still at €80 as of writing, more than 4 times the ~€20 exactly a year ago.[5] Mainly caused by higher demand from Asia, colder temperatures, and decreasing Russian supply.

In light of this, a group of European Parliamentarians has requested an investigation into Gazprom, the Russian gas giant majority-owned by the Russian government, accusing them of purposely limiting supply, to push through Nord Stream 2.[6] A new 2nd gas pipeline directly from Russia to Germany.

Putin initially rejected these claims, but not much later proved to be doing exactly that, albeit with some plausible deniability. Russian gas shipments would drastically increase, he said, 'the day after the regulators approve Nord Stream 2'.[7]

ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html#carouselControls?lang=en ↩︎

ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html ↩︎

hcss.nl/report/russias-unsustainable-business-model/ ↩︎

eeas.europa.eu/headquarters/headquarters-homepage/104078/russia-speech-high-representativevice-president-josep-borrell-ep-plenary_en ↩︎

tradingeconomics.com/commodity/eu-natural-gas ↩︎

reuters.com/business/energy/group-eu-lawmakers-seeks-probe-gazproms-role-gas-price-surge-2021-09-17/ ↩︎

ft.com/content/e5f74353-73e5-4273-ae13-cc3d0985e606 ↩︎

Resilient & effective future system

Renewable energy is not restricted to countries that happen to have oil or gas fields. Everywhere does the sun shine and the wind blow.

Of course, there are large differences in cost and efficiency. The North Sea for example is perfectly suited for wind energy, and the south of Europe, as well as Northern-Africa, are perfect for solar.

These differences however, are manageable enough to decentralize production to a mix of domestic, European and regional production. Consequently there are a lot more options, including which regional partners to choose, for a much more diversified supply. It gives the option to pick and choose, instead of being limited to a small number of producers that take advantage of monopolies.

There are thus two, opposite benefits:

- Reducing fossil fuel imports of (potentially hostile) regimes, which gets rid of the dependencies, and the cashflow that supports them.

- Redirecting that money to renewable power generation within the EU, or to select regional countries to develop their economy & relations with them, such as Morocco or Ukraine.

For the European Union, it's a win-win.

Within the EU, stimulating renewable energy generation is a tremendous opportunity to boost the economy, secure their energy supply, and become a frontrunner in this global transition of energy.

Energy Security & Diplomacy

Energy security, is defined by the International Energy Agency as: the uninterrupted availability of energy sources, at an affordable price. History reminds us of the oil crises of the 1970's and 2000's, but even as of writing, there is currently a worldwide shortage of natural gas.[1]

The International Energy Agency, which was actually set-up after the energy crises of the 70's, made a rare public statement: "The IEA believes that Russia could do more to increase gas availability to Europe and ensure storage is filled to adequate levels in preparation for the coming winter heating season."

Gazprom and Russia themselves, said its due to Russian and Asian demand increasing, and that they're are fulfilling all contractual obligations with Europe. Importantly, the IEA also said: “Well-managed clean energy transitions are a solution to the issues that we are seeing in gas and electricity markets today – not the cause of them.”

The benefits here are obvious. Remove the dependency on a very small group of unreliable external countries. Yielding greater energy security, in terms of price as well as uninterrupted availability. It will also stop the enormous flow of money away from Europe into the hands of non-friendly nations, and stop the EU from losing bargaining power.

It's critical infrastructure that can be built right here in Europe, or with carefully selected partners.

Instead of sending money to Russia, it can go to projects within the EU.

If that capacity isn't enough, or is significantly cheaper elsewhere, the EU could carefully select regional partners in North Africa, or Eastern Europe. It would be mutually beneficial, and could go hand in hand with democratization or environmental reform.

Positioning Europe as a credible partner for sustainable development.

bloomberg.com/news/articles/2022-01-04/europe-s-energy-supply-crisis-has-the-eu-at-the-mercy-of-putin-and-the-weather ↩︎

Boost to the Economy

Renewable energy is cheap, a lot cheaper than you might think. According to IRENA, the International Renewable Energy Agency, in 2020 62% of new renewable projects were cheaper than the cheapest fossil fuel options.[1]

Those are global numbers: "In Germany, no existing coal plant has lower operating costs than new solar PV or onshore wind capacity."

And costs are still projected to decrease substantially as scale increases even more, going far below the cheapest operating fossil fuel plants, especially non-reactive coal plants that are less flexible to demand & supply changes. [2]

These numbers are all from before the fossil fuel price increases.

The electrification of transport has huge economic savings potential, too.

Medium-size battery electric cars already have a lower total cost of ownership (TCO) than their fossil fuel counter parts.[3]

Small and large cars are projected to follow that path within 5 years.

This is mainly because of lower fuel costs (electricity vs gas/diesel), reduced taxes, and lower maintenance, which is the result of less moving parts.

This results in proportionally more benefits to buyers of 2nd hand electric cars. The same study thus calls electric cars the most 'equitable' out of all vehicles, as the high initial costs are paid by wealthier early adopters, while the savings in fuel and maintenance trickle down significantly to 2nd hand buyers.

Because electric vehicles are so efficient, and require so little maintenance, they will cost much less over their lifespan than gas or diesel vehicles. Which is great for the economy as the money can be spent on other things instead. And that's without even getting into the public health benefits & cost-savings, from less air pollution.

For the European Union, it's an incredible opportunity to invest in member states for a cause that benefits everyone, and every department.

It benefits Europe's environment, economy, geopolitical standing and even public support both within and outside of its borders.

Instead of controversial bailouts and loans to the South and East, investments in renewable energy production are much more obviously beneficial to all parties involved, and their citizens. A bailout of an Italian bank, for example, is a lot harder to explain to a voter than a loan for a large solar park that will provide green energy throughout the region, for cheap prices.

Frontrunner in global transition

While it requires large upfront investments, there are many benefits to being the frontrunner in a global energy transition. By now, it is obvious that the world is going green, it's just a question of how quickly.

Facing this, Europe can either become an importer of this transition, or exporter. It would be a shame to lose the dependence on Russia and the Middle East - only to become dependent on Chinese green technology, for example.

Europe has the universities, and the know-how. What is needed is large-scale deployment and production, through bold investments & political backing.

The importance of this is painfully highlighted by a story from the past:

German solar panel producers were once the worldwide market leader.

But in barely 5 years, there were no German manufacturers beyond niche products left. After heavy government support, resulting in production at an enormous scale, and allegations of selling below cost, Chinese companies flooded the market, and bankrupted German producers.[1] China now produces the vast majority of solar panels, at the cheapest prices, and is virtually unrivalled. It's often thought that this was inevitable due to their lower wages, but this is only a part of the equation. Researchers at MIT and NREL found that a large-scale, and well working supply-chains are the most important factors to their low cost.[2]

“There’s a chicken-and-egg problem: consistent demand is needed to provide manufacturers with access to the capital required to achieve large-scale production, but large-scale production will be necessary for solar power to compete as an energy source without subsidies,”

said the author of the study.

China beats this problem by heavily supporting the industry at scale.

This initially costs a lot of money and is very inefficient, but overtime, through scale & cheaper supply-chains yields the lowest cost production.

Which then creates genuine demand, across the world, that makes it all worth it.

Of course, cheap labour, cheap coal-electricity, and alleged forced Uyghur-labour[3] do make an impact on low costs in China. But they are still a smaller factor than scale and supply chains(!), and by themselves are another reason for why Europe should strive to be as independent as possible.

While the solar panel industry is probably not worth trying to recover, at least without significant technological gains, many other sectors of the green industry are still up for grabs.

Wind turbines, batteries, hydrogen, synthetic kerosene, and recycling are all growing exponentially, set to be major industries of the future.

And though the generation of renewable electricity is maturing as an industry, there is still a lot of development needed in storage and distribution.

These industries are not as sexy, and will struggle to make a headline. But they are critical for any renewable economy, and will be a large part of the valuechain in the coming decades. Leadership in these areas is key for Europe, and will not only benefit the continent for its own needs, but will also be an important export for the economy - as well as for Europe's soft-power and international credibility.

These industries need to be heavily supported through research, low-cost funding, subsidies, regulation and promotion.

“From an external-geopolitical perspective, those countries that today invest in renewable energy sources and technology may become the dominant geopolitical players tomorrow.” [4] -David Criekemans

This is not by accident, nor a secret to the Chinese.

A recent study by The Green Finance Committee of China Society for Finance and Banking, a research group set-up by the People's Bank of China, wrote:

"China has unique advantages in large-scale R&D and promotion of green and low-carbon technologies. China is a major manufacturing country, which can achieve economies of scale effects and supply-chain agglomeration effects. China is already competitive globally in solar power, wind power, electric vehicles and batteries." [5]

Public Opinion

Beyond the economics and world politics, there is a clear case for sustainable leadership, for Europe's citizens.

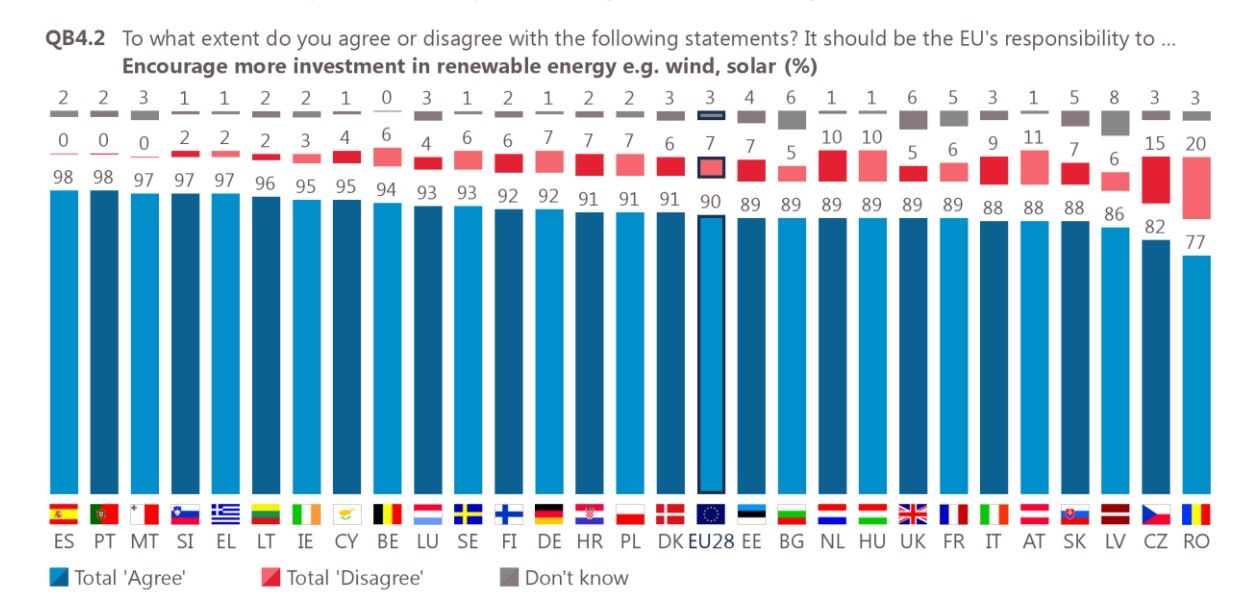

To the statement 'Should the EU encourage more investment in renewable energy?', an average of 90% across the EU agreed. With another 3% not sure.[6]

Older people that were retired, were more likely to be in the 7% that disagreed. Suggesting public opinion will only get stronger in favor for renewables in the future, as young people reach voting age, and the elderly pass away.

And who can blame them? Beyond the dooming prospect of climate change, air pollution is still estimated to cause around 300,000 premature deaths across the European union.[7] Europe has some of the strictest regulations on pollution, and because of it air pollution has steadily dropped since 1990, but the majority of electricity is still generated by fossil fuels and so are the cars.

An entirely renewable economy in Europe will result in some of the cleanest cities the continent has seen since the Industrial Revolution.

"It is reasonable to expect that champions of a high-renewables or other low-emissions future could over time enjoy significant soft power and credibility advantages over states not prepared to respond adequately to the threat of climate change." [8] - Center on Global Energy Policy

Beyond the security and economic angle, positioning Europe as the global frontrunner of green energy and sustainable technologies will be good for public opinion within the EU, as well as outside of it - and it will support European companies in the industry to become global giants.

Conclusion

We know the future of energy is renewable.

It's not a question of 'if', but 'when?'.

Facing this fact, Europe should aggressively embrace renewables in every way it can. To become market leaders, rather than importers, of the renewable revolution.

If not for the environment, it's also just good politics.

dw.com/en/chinese-exports-crushing-german-solar-industry/a-16031596 ↩︎

pubs.rsc.org/en/content/articlepdf/2013/ee/c3ee40701b ↩︎

nytimes.com/2021/06/24/business/economy/china-forced-labor-solar.html ↩︎

the geopolitics of renewable energy 2011 Criekemans ↩︎

asiatimes.com/2022/01/china-projects-75-trillion-in-carbon-neutrality-investment/ ↩︎

europa.eu/eurobarometer/surveys/detail/2238 - summary page 17 ↩︎

eea.europa.eu/publications/air-quality-in-europe-2021/health-impacts-of-air-pollution ↩︎

energypolicy.columbia.edu/sites/default/files/CGEPTheGeopoliticsOfRenewables.pdf ↩︎